The biodegradable plastic market is evolving fast, driven by regulatory shifts, sustainability demands, and innovation. As 2025 approaches, manufacturers must stay ahead of key trends shaping product development, market growth, and competitive strategy. This article outlines the crucial insights every producer needs to navigate the changing landscape.

1. Biodegradable Plastic Market Size and Growth Outlook

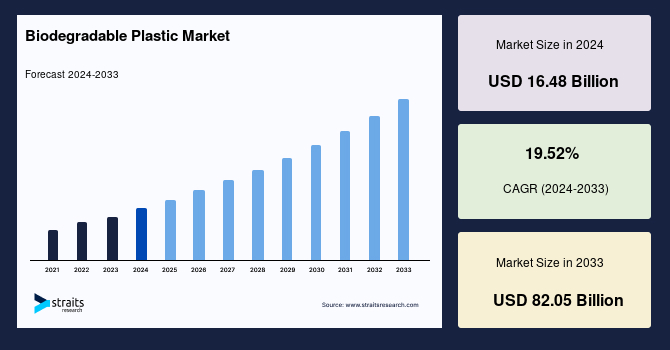

The biodegradable plastic market is booming, and the numbers tell an exciting story. In 2024, the global market was valued between USD 5.8 billion and USD 16.48 billion, depending on the source.

Looking ahead, experts project it could soar to anywhere from USD 11.25 billion to USD 82.05 billion by 2032, with a compound annual growth rate (CAGR) ranging from 8.63% to an impressive 19.52%.

What’s driving this surge? This growth is fueled by rising demand for sustainable alternatives to traditional plastics, especially in packaging and agriculture.

Regionally, Europe is leading the charge, thanks to strict regulations like the EU’s Single-Use Plastics Directive and a strong push for composting infrastructure. Asia-Pacific, particularly China and India, is catching up fast due to large-scale investments and increasing waste management pressures. In North America, the U.S. shows steady demand growth, with cities and states enacting their own green mandates.

These trends signal real opportunity—but also rising expectations. Manufacturers need to adapt quickly to stay relevant.

2. Key Drivers Shaping the Biodegradable Plastics Industry

Several forces are reshaping the biodegradable plastics landscape—and they’re picking up speed in 2025.

2.1. Regulatory Pressures

Governments worldwide are cracking down on conventional plastics. The EU Single-Use Plastics Directive has banned several disposable items, and China is targeting a nationwide phase-out of non-degradable plastic by 2025. These policies are pushing manufacturers to urgently find sustainable alternatives.

2.2. Consumer Demand

Shoppers are increasingly choosing products with eco-friendly packaging. This is especially true in sectors like food, cosmetics, and retail, where biodegradable materials are seen as premium and responsible. Packaging isn’t just functional anymore—it’s a sustainability statement.

2.3. Corporate Sustainability Commitments

Big brands are making bold promises. Unilever and Nestlé have pledged to transition significant parts of their packaging to biodegradable or compostable materials by 2025. These goals are cascading through the supply chain, creating demand for scalable, certified solutions.

2.4. Technological Advancements

Materials like PLA, PHA, and starch-based bioplastics are improving rapidly. New blends offer better durability, heat resistance, and cost-efficiency—making them viable even in mainstream packaging and industrial applications. This tech evolution is lowering barriers to entry for manufacturers.

3. Biodegradable Plastic Market Segmentation

3.1. By type

Biodegradable plastics aren’t one-size-fits-all. Each material type has its own strengths and preferred use cases—and knowing the difference is key for manufacturers in 2025.

- Polylactic Acid (PLA)

PLA is the most widely adopted biodegradable plastic, especially in food packaging, disposable cutlery, and medical devices. Its biocompatibility and clarity make it ideal for both consumer products and biomedical applications like sutures and drug delivery systems. - Polyhydroxyalkanoates (PHA)

PHA is gaining ground, especially in agriculture and healthcare, thanks to its ability to fully biodegrade in marine environments. Despite higher production costs, its performance in moisture-rich or sensitive environments makes it a strong choice for niche applications. - Starch-Based Blends

With an estimated 41.7% market share in 2024, starch blends are the most cost-effective option. They’re popular in single-use items like bags, straws, and agricultural mulch films, where short-term use and compostability are key. - PBAT and PBS

These materials are known for their flexibility and durability, making them ideal for stretch films, shopping bags, and consumer packaging. PBAT, often blended with PLA or starch, enhances toughness and elongation for practical daily-use items.

3.2. By application

Packaging remains the dominant application, accounting for 53% of the total biodegradable plastics market, followed by agriculture, consumer goods, textiles, and even some automotive components. As industries seek greener alternatives, demand is rising for tailored biodegradable solutions across all sectors.

4. Regional Insights for Biodegradable Plastic Manufacturers

Understanding regional dynamics is critical for manufacturers looking to scale or enter new markets. Here’s how the landscape is shaping up in 2025:

4.1. North America

In the U.S. and Canada, demand for bio-based packaging is on the rise, especially in food service and retail.

Growing investments in industrial composting infrastructure are making it easier for municipalities to support biodegradable waste streams. Local bans on single-use plastics in cities and states continue to push the shift toward compostable alternatives.

4.2. Europe

Europe remains the global leader in biodegradable plastics, driven by policies like the EU Single-Use Plastics Directive and strong consumer advocacy.

Countries like Germany, France, and the Netherlands are spearheading adoption through strict regulations and public sector support. The region also leads in certifications and eco-labeling, boosting transparency and trust in biodegradable products.

4.3. Asia-Pacific

APAC is experiencing the fastest growth, thanks to booming agriculture, food, and beverage sectors, particularly in China, India, and Southeast Asia. Governments are introducing restrictions on conventional plastics, and local manufacturers are ramping up biodegradable alternatives to meet export and domestic demand.

4.4. Latin America and Middle East & Africa

Latin America and the Middle East & Africa are emerging markets with exciting potential. New manufacturing facilities are popping up, driven by growing awareness of sustainability and investments in green technologies.

In Latin America, Brazil is leading with biodegradable packaging for food and agriculture.

While in the Middle East & Africa, countries like South Africa are starting to embrace bioplastics as part of broader environmental goals.

5. Challenges and Considerations for Manufacturers

While the biodegradable plastic market holds strong potential, manufacturers must navigate several challenges to succeed in 2025.

- Economic Barriers

Cost remains a key hurdle. Biodegradable plastics, especially materials like polyhydroxyalkanoates (PHA), are often 30–70% more expensive than conventional plastics due to raw material prices and lower economies of scale. These cost gaps can make it difficult for smaller players to compete or for brands to fully commit without premium pricing or government support.

- Infrastructure Limitations

Many regions still lack the proper infrastructure for composting or industrial biodegradation. Without access to facilities that can process biodegradable plastics, even certified products may end up in landfills—limiting their environmental benefit and frustrating consumer expectations.

- Misconceptions and Greenwashing

There’s widespread confusion between terms like “biodegradable,” “compostable,” and “bio-based.” This leads to misuse, and even accusations of greenwashing.

Many consumers misunderstand what “biodegradable” means, often assuming all bioplastics break down easily in any environment. This misconception can lead to skepticism when products fail to degrade in home composts or landfills.

Manufacturers must ensure product labeling is clear, compliant, and certified, and they need to educate both consumers and supply chain partners about proper use and disposal.

Overcoming these challenges requires transparency, collaboration, and investment—not just in technology, but in trust.

6. Actionable Strategies for Manufacturers in 2025

To thrive in the booming biodegradable plastics market, manufacturers need to act strategically. Here are five practical recommendations to help you stay competitive, meet market demands, and drive growth in 2025.

- Prioritize R&D for Innovation

Investing in research and development is essential. Focus on developing materials like polylactic acid (PLA) or polyhydroxyalkanoates (PHA) with enhanced durability, heat resistance, or faster degradation rates. For example, improving PHA’s cost-efficiency could unlock its potential in agriculture and medical applications.

- Align with regulatory standard

Compliance with global standards like ASTM D640OKUP or EN 13432 is non-negotiable. These certifications validate your products’ biodegradability and compostability, building trust with consumers and regulators.

- Expand into high-growth region

Asia-Pacific, led by China and India, is the fastest-growing market for biodegradable plastics, driven by agriculture and packaging demand. Emerging markets in Latin America and Africa are also showing promise with new manufacturing facilities.

Establish local partnerships, set up regional production hubs, or tailor products to meet specific needs—like mulch films for Asian farmers—to capture these opportunities and boost market share.

- Leverage AI and automation

Artificial intelligence and automation can transform your operations. Use AI to optimize supply chains, predict raw material needs, or improve material formulations.

For instance, AI-driven quality control can ensure consistent product performance, helping you scale efficiently while keeping costs in check.

- Educate and Build Consumer Trust

Misconceptions about biodegradability can undermine your efforts. Launch campaigns to teach consumers how to dispose of bioplastics correctly.

Clear labeling and partnerships with waste management programs can reinforce your commitment to sustainability.

By building trust and clarity, you’ll strengthen your brand and encourage wider market acceptance.

7. FAQs About Biodegradable Plastics for Manufacturers

What are the fastest-growing segments in the biodegradable plastic market?

The fastest-growing segments are packaging, with a 53% market share, and agriculture, driven by mulch films. Polylactic acid (PLA) and starch blends lead due to their versatility and cost-effectiveness, especially in food packaging and disposable goods.

How can manufacturers reduce production costs for bioplastics?

Manufacturers can cut costs by investing in R&D for efficient materials, using AI-driven automation, and securing stable, low-cost raw material supplies like corn or sugarcane. Collaborating with suppliers also helps streamline production.

Which regions offer the most opportunities for market expansion in 2025?

Asia-Pacific, particularly China and India, offers the most opportunities due to booming packaging and agriculture sectors. Europe remains strong, while Latin America and Africa are emerging markets.

What are the key certifications for biodegradable plastics?

Key certifications include ASTM D6400 for compostability, EN 13432 in Europe, and the Biodegradable Products Institute (BPI) certification, ensuring products meet strict environmental standards.

8. EuP Egypt – World-Leading Bioplastic Manufacturer

As global demand for biodegradable plastics accelerates, EuP Egypt, a proud member of the globally renowned EuP Group, is at the forefront of the biodegradable plastics revolution, offering innovative solutions to meet the growing demand for sustainable materials.

With over 17 years of experience, EuP Egypt leverages German-engineered technology to produce its flagship biodegradable plastic compounds, BioNext.

Our BiONext series is developed from renewable sources like PLA, PHA, starch, and PBAT—ensuring full biodegradability within 12 months.

More than just eco-friendly, BiONext offers excellent mechanical strength, high elongation, glossy surface finish, and ease of processing—making it ideal for applications like food packaging, agricultural mulch, and disposable goods.

With a production capacity of 0.8 MT/year and exports to over 95 countries, EuP Egypt combines advanced technology, tailored solutions, and competitive pricing to support manufacturers in reducing environmental impact without compromising on quality.

BiONext isn’t just a material—it’s a step toward a circular, responsible future for plastics.

9. Conclusion

Biodegradable plastics are reshaping the future of manufacturing—driven by innovation, regulation, and rising global demand. For producers aiming to lead in 2025, understanding market trends and adopting sustainable solutions like BiONext is essential.

Ready to transition to high-performance biodegradable compounds? Contact EuP Egypt today.

References:

(1) Market.us, Global Biodegradable Plastic Market Trends, and Forecast 2023-2032 [Link]

(2) Straits Research, Biodegradable Plastic Market Size, Share & Trends Analysis Report By Type (PLA (POLYLACTIC ACID), PBAT (POLYBUTYLENE ADIPATE TEREPHTHALATE), PBS (POLYBUTYLENE SUCCINATE), PHA (POLYHYDROXYALKANOATES), Starch Blends, Others), By Application (Packaging, Agriculture, Consumer Durable, Textile, Others) and By Region(North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033 [Link]

(3) Grand View Research, Biodegradable Plastic Market Size, Share & Trends Analysis Report By Process (Starch Blends, Polylactic Acid), By End-use, By Region, And Segment Forecasts, 2024 – 2030 [Link]

(4) Markets and Markets, Biodegradable Plastics Market Size, Industry Share Growth [Link]